about filing ITR before 15th June, with emojis and clear pros & cons, plus eligibility info:

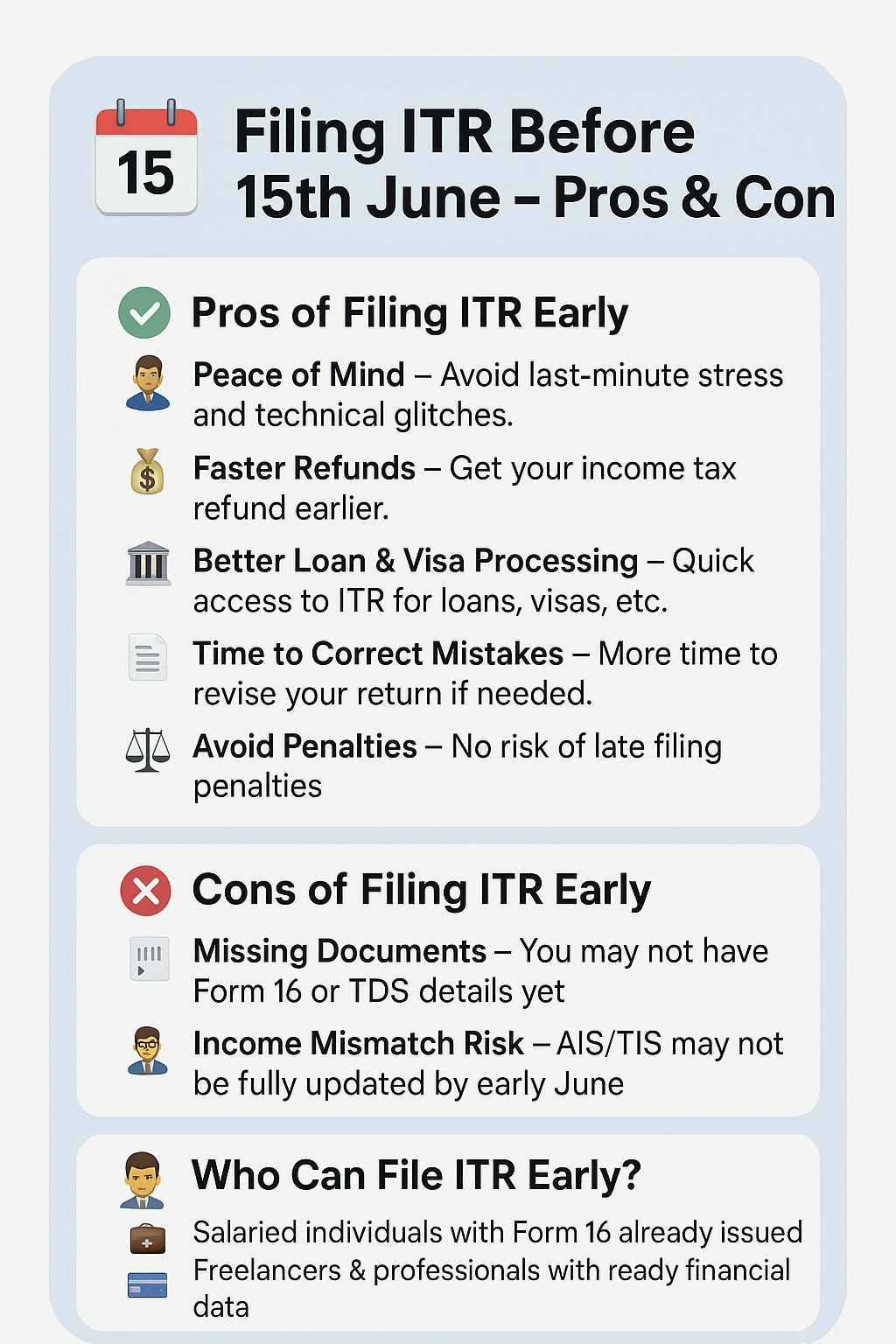

Benefits of Filing ITR Before 15th June

🧘♂ Peace of Mind – Avoid last-minute stress and technical glitches.

💰 Faster Refunds – Get your income tax refund earlier.

🏦 Better Loan & Visa Processing – Quick access to ITR for loans, visas, etc.

📑 Time to Correct Mistakes – More time to revise your return if needed.

⚖ Avoid Penalties – No risk of late filing penalties.

Drawbacks of Filing ITR Too Early

🧾 Missing Documents – You may not have Form 16 or TDS details yet.

🧮 Income Mismatch Risk – AIS/TIS may not be fully updated by early June.

🔄 Re-filing May Be Needed – If income details change, you’ll have to revise.

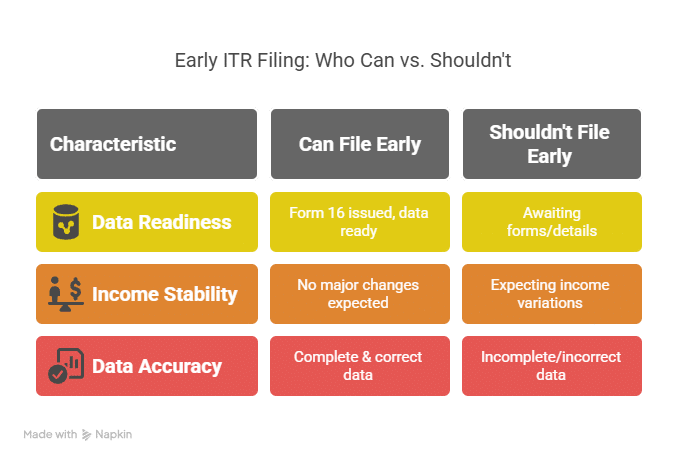

Who Can File ITR Early?

- Salaried individuals with Form 16 already issued 🧑💼

- Freelancers & professionals with ready financial data 💼

- People with no major financial changes or updates expected 💳

Who Shouldn’t File ITR Early?

- If your Form 16 or TDS details are not yet available 🧾

- If you expect more income or changes (like capital gains, interest, etc.) 📈

- If AIS/TIS data is incomplete or incorrect at the time 📊

Pro Tip

Always match your ITR with AIS/TIS & Form 26AS before filing to avoid mismatch notices from the IT department.

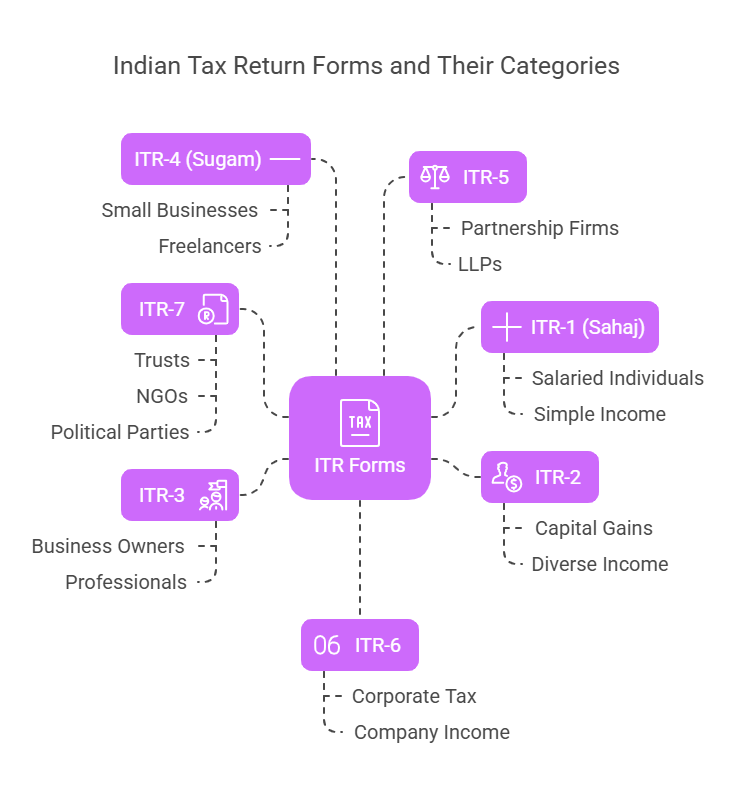

Different types of ITR and who should file.

What Is Form 26AS in income tax

- Displays all transaction for which tax was deducted/collected

What Is AIS in income tax

- It includes details form 26AS and other transactions for which tax was not paid (savings bank account interest, MFs, bonds, properties transactions, etc.)

What Is SFT in income tax

- Part of AIS reporting that includes high-value transactions reported by financial institution, companies or individuals

Contact us for ITR Filing

At Finance And Tax Guide, we are offering comprehensive income tax return filing services designed to make the tax process as smooth and stress-free as possible. Our team of experienced tax professionals ensures accurate and timely filing, helping you minimize liabilities and maximize potential refunds. Whether you’re an individual, a small business, or a corporation, we take the time to understand your unique financial situation, offering personalized solutions to meet your needs. Trust us to handle the complexities of tax filing so you can focus on what matters most to you.

Don’t rush to file your ITR

What can happen?

- Taxpayers may file ITR before Form 26AS and AIS are updated.

- Deadline for both TDS filing and SFT (used for Form 26AS and AIS) is 31 May

- It takes around a week for the data to be processed and reflect in AIS

- The income tax portal may allow ITR filing before that (not yet opened for now).

What if you file early?

- You might report TDS and income different form what’s in Form 26AS/AIS

- In that case, IT department may issue a notice

- If the TDS claim had not been given, a revised return needs to be filed

- After 31 December, updating ITR attracts higher taxes (interest + penalty)

What’s the issue

The tax paid and income details on the tax portal may not match with ITR filed

What should you do?

- Wait for Form 26AS, AIS to get updated

- Usually, it comes by 15 June

- Meanwhile, taxpayers can compile financial data to match with AIS.

- File revised return by 31 December to avoid higher taxes

Real-Life Illustration for ITR filling

- TDS from salary: ₹10000/month

- When employer files TDS (Form 24Q): 31 May (deadline)

Reflected in Form 26 AS: 15 June (15 day processing)

- Paid ₹ 1.2 lakh salary TDS for the fiscal year

- Files ITR on 25 May (put ₹1.2 lakh TDS)

- But the employer hasn’t yet reported the March quarter TDS.

- Portal only shopws TDS for nine months (₹90000)

- IT department may issue notice to explain the remaining ₹30000

SFT reporting, which captures high-value transactions (required for AIS) by entities, is also on 31st May

If the ITR is filed with nine-month income, details will get updated later. Have to file a revised return when Form 26AS gets updated

Conclusion

iling ITR before 15th June can save you time and help you receive refunds faster — but only if your data is complete. Always verify your AIS, Form 26AS, and TDS details before submission. When in doubt, wait till mid-June or consult a tax advisor.

Contact US

FAQs

Is it mandatory to wait until 15th June to file ITR?

No, but it’s recommended to ensure your Form 26AS and AIS are fully updated.

Can I revise my ITR if I file early and something changes?

Yes, but only until 31st December, and revisions after that may incur interest and penalties.

How to check if my AIS/Form 26AS is updated?

Log in to https://incometax.gov.in → Go to ‘Services’ → Check AIS & 26AS.

What happens if my TDS is not reflected in Form 26AS yet?

You may not get credit for that TDS when filing ITR. It’s safer to wait until it appears in Form 26AS to avoid mismatch and notices.

What is the penalty for late filing of ITR?

If you miss the 31st July deadline, you may be fined up to ₹5,000 under Section 234F. Interest may also apply under Sections 234A, 234B, and 234C.

Can I file ITR without Form 16?

Yes, if you have accurate salary slips and can calculate your taxable income. But Form 16 makes it easier and more reliable.

Is AIS mandatory for filing ITR?

AIS is not mandatory to attach, but it’s highly recommended to match your income details with AIS to avoid discrepancies.

How do I know if my AIS or Form 26AS is updated?

You can check updates by logging into the Income Tax Portal, under Services → AIS → Download/Preview.

What should I do if there’s a mismatch in TDS or income data?

Either wait for the update or file your return now and submit a revised return later once all data is accurately reflected.

When is the best time to file ITR for FY 2024–25?

Generally, the safest window is 15th June to 15th July — when Form 26AS, AIS, and SFT data is fully updated but still early enough to beat last-minute issues.

Can salaried people claim deductions if they file early?

Absolutely. Early filing does not affect your eligibility for Section 80C, 80D, HRA, and other deductions, as long as you have proper documentation.