Section 115JB explains how a company may have to pay a minimum amount of tax based on

its book profit rather than its regular income. Book profit refers to the profits reported in the

company’s financial statement, and this rule ensures that a company pays tax even if its

taxable income is low or zero.

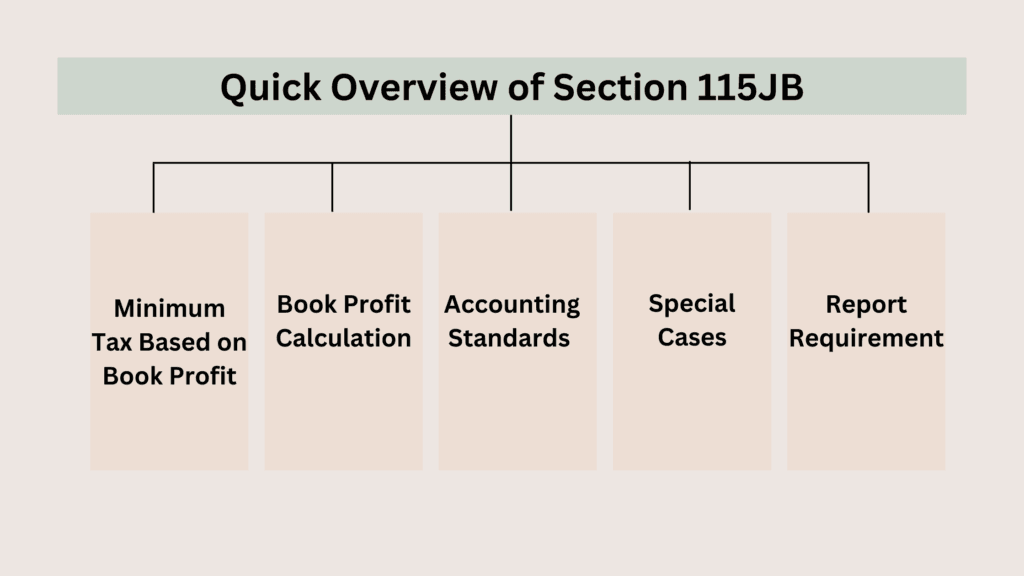

Key Points of Section 115JB:

Minimum Tax Based on Book Profit:

- o If a company’s regular tax (based on its total income) is less than 18.5% of its book profit, then the company must pay tax on the book profit instead. This ensures that the company pays a minimum tax.

- Important Update (2020): For the assessment years from 2020 onwards, the tax rate was reduced from 18.5% to 15%.

Book Profit Calculation:

- Book profit is calculated using the company’s profit and loss statement, which is prepared according to accounting rules.

- o Some adjustments are made to the profit to calculate book profit, like adding taxes paid or removing certain expenses or reserves that don’t actually affect the company’s financial condition.

Accounting Standards:

- Companies must follow certain accounting rules (like the Companies Act, 2013) when preparing their financial statements.

- If the company has a different financial year compared to the assessment year under tax laws, adjustments are made to align the accounting policies and standards.

Special Cases:

- Foreign Companies: If a foreign company doesn’t have a permanent establishment (a significant presence) in India, or its income is exempt under certain agreements, these rules don’t apply to them.

- Life Insurance Companies: The minimum tax rules don’t apply to life insurance companies.

- International Financial Services Centers (IFSC): If a company is located in an IFSC and only earns income in foreign exchange, the tax rate is reduced to 9% instead of the usual 15%.

Report Requirement:

- Companies covered under this section must get a certification from an accountant, confirming their book profit has been calculated correctly.

- The report must be submitted with the income tax return or before the specified date.

Why Is Section 115JB Important?

The rule ensures that no company can avoid paying taxes by reporting very low profits in

its tax filings. Instead, the company is taxed on a minimum level based on how well it is

doing financially, even if it shows less income on paper.

In essence, it’s a safeguard to make sure companies pay at least a basic amount of tax,

even if their calculated taxable income is low or negative.